Eric S. Maskin: Government involvement in credit and financial markets essential for maintaining credit stability

The following is a summary of Eric S. Maskin’s keynote address to attendees at the Fifth Conference of Government and Economics held at Tsinghua University, Beijing, on April 22, 2023. Dr. Maskin is a 2007 Nobel Laureate in Economics, the Adams University Professor at Harvard University, and Co-President of SAGE.

On April 27, 2023, the Fifth Annual Conference of Government and Economics, co-hosted by the Society for the Analysis of Government and Economics (SAGE) along with Tsinghua University’s School of Social Sciences and the Academic Center for Chinese Economic Practice and Thinking (ACCEPT), was broadcasted online. The Co-President of SAGE, Eric S. Maskin, who is a 2007 Nobel Laureate in Economic Sciences and Adams University Professor at Harvard University, delivered a keynote address to attendees at the conference in a video presentation.

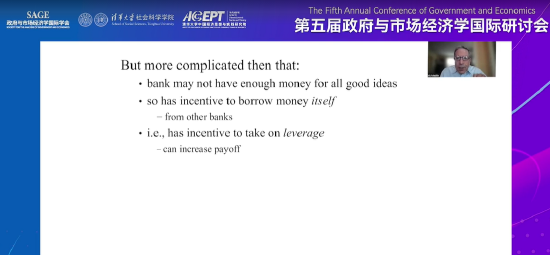

Maskin commented that the recent bank failures in the United States and Europe have brought back memories of the 2008 financial crisis. In the face of these latest bank failures, governments have moved quickly to calm bank depositors. While it may be too early to conclude that a crisis has been completely averted, one cannot deny the government’s role in supporting the functioning of credit and financial markets, which has been of the utmost importance for maintaining credit stability. Moreover, he said that the credit market is the lifeblood of all other sectors in the economy and, in a sense, represents the most important market. Unlike the regular market, the impact of a crisis in the credit market will not only often be magnified, but also lacks the means for self-correction: in the process of issuing leveraged loans and high-risk loans, a bank will not consider that its own behavior might affect other banks, which then often leads to the overamplification of impacts from such behaviors on the broader market. In this way, small problems can quickly develop into big problems, and the failure of a handful of banks can precipitate large-scale bank failures.

Maskin proposed that negative externalities in the credit market need to be corrected through ex ante and ex post interventions: after one or more banks become distressed, the government can provide emergency relief to these banks by providing them with enough capital to continue operating and lending. However, such ex post bailout policies could actually encourage banks to take on more risk and make riskier loans, which in turn could fuel a potential financial crisis in the future, creating what is otherwise known as a “moral hazard” problem. Therefore, government measures that support ex ante intervention, and greater market supervision by extension, are vitally important. The most significant form of regulation involves placing constraints on bank leverage and imposing capital requirements. Given the volume of loans granted by any given bank, the government should require that such banks maintain a minimum amount of capital reserves to support these loans, while limiting the amount of loans the bank can borrow from other banks. Thus, by imposing capital requirements and restrictions on leveraged loans, governments will be tackling the problem at its source, thereby preventing banks from getting into trouble in the first place.