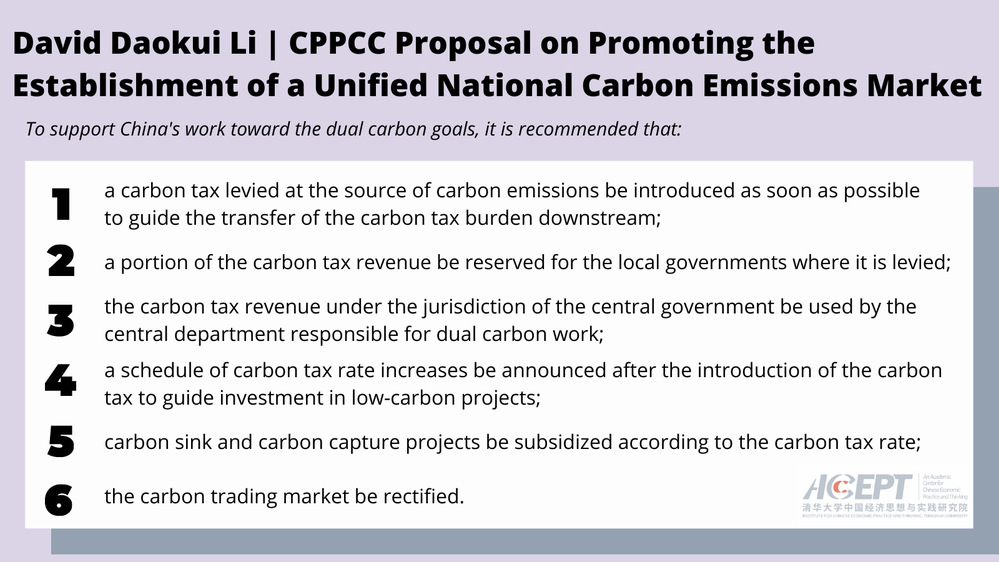

David Daokui Li: CPPCC Proposal on Promoting the Establishment of a Unified National Carbon Emissions Market

On March 5, 2022, David Daokui Li submitted the following Proposal on Promoting the Establishment of a Unified National Carbon Emissions Market to the CPPCC. Professor Li is the Director of the Academic Center for Chinese Economic Practice and Thinking (ACCEPT) and a nonpartisan member of the CPPCC National Committee. For the original proposal in Chinese, click here.

Abstract: Peaking carbon emissions and reaching carbon neutrality are China's solemn commitments to the international community, and also an important window to show the world the advantages of the system of socialism with Chinese characteristics. In the current work toward these dual carbon goals, some relatively prominent problems have emerged. Namely, various departments and regions set their own policies, and the pursuit of locally optimal outcomes can lead to sub-optimal outcomes in the larger context. This has a direct impact on economic operations. In order to solve this problem, it is recommended to promote the establishment of a unified national carbon emissions market. In such a market, all regions and sectors should pay the same unit cost for direct or indirect carbon emissions, i.e., the carbon price. At the same time, they can also obtain revenue from carbon sinks or carbon capture according to the same carbon price.

To this end, it is specifically recommended that: 1) a carbon tax levied at the source of carbon emissions be introduced as soon as possible to guide the transfer of the carbon tax burden downstream; 2) a portion of the carbon tax revenue be reserved for the local governments where it is levied, so as to mobilize local governments and promote the carbon transition in the relevant regions; 3) the carbon tax revenue under the jurisdiction of the central government be used by the central department responsible for dual carbon work, mainly to subsidize the research and development of carbon alternative technologies and subsidize the carbon sink industry; 4) a schedule of carbon tax rate increases be announced after the introduction of the carbon tax to guide investment in low-carbon projects; 5) carbon sink and carbon capture projects be subsidized according to the carbon tax rate; and 6) the carbon trading market be rectified.

Peaking carbon emissions and reaching carbon neutrality are China's solemn commitments to the international community, and also an important window to show the world the advantages of the system of socialism with Chinese characteristics. As such, these commitments must be resolutely implemented and fulfilled.

In the current work toward China’s dual carbon goals, some relatively prominent problems have emerged. These problems primarily manifest in the different policies across various departments and regions, which each put forth their own carbon reduction goals and planning. This can result in outcomes that are optimal on the local level but suboptimal in the larger context, with a direct impact on economic operations.

How can we solve the current problem? The answer lies in the establishment of a unified national carbon emissions market. In such a market, all regions and sectors should pay the same unit cost for direct or indirect carbon emissions, i.e., the carbon price. At the same time, they can also obtain revenue from carbon sinks or carbon capture according to the same carbon price.

Why is it important to establish a unified national market for carbon emissions? The fundamental reason is that, in terms of results, the impact of carbon emissions on the dual carbon targets is the same in any given region or sector. However, the cost of reducing emissions is entirely divergent across different regions and sectors. To promote national emissions reductions, it is important to reduce carbon in the regions and sectors with the lowest cost of reduction rather than prescribing the same directive to all sectors across the country. But how can we know which region or sector has the lowest cost of carbon reduction? This requires the establishment of a unified national carbon market, through the operation of which we can realize a standardized national price for carbon emissions. According to the standardized national carbon price, regions and sectors with lower carbon reduction costs than the national carbon price will naturally accelerate carbon reduction, thus gaining economic benefits. Conversely, regions with high carbon reduction costs should not reduce emissions, and may even increase emissions, but the overall effect will be a comparative reduction in carbon.

More importantly, the government can gradually raise the price of carbon emissions through a uniform carbon tax to promote the national carbon reduction process and gradually achieve the dual carbon goals.

The theoretical basis for establishing a unified national carbon emissions market is government and economics, which is the summation of China's experience in reform and opening up over the past 40+ years, a phenomenon that has already attracted widespread international attention. China should lead global action on carbon reductions by promoting the establishment of a unified national carbon emissions market, thus highlighting the advantages of the system of socialism with Chinese characteristics.

To this end, the following specific proposals are put forward:

First, a standardized carbon emissions tax should be introduced as soon as possible. It is recommended that this tax be levied at the sources of carbon emissions, such as coal mines, oil and gas fields, and the import of crude oil and natural gas. It is recommended to start with a relatively low carbon emissions tax rate, and to gradually guide the carbon taxes on upstream production and import links toward the downstream of the industry. In this way, every end user will feel the cost of carbon emissions in different products, and will rationally choose low-emission products according to their prices. In addition, a major advantage of introducing a carbon tax is to win the initiative in the international arena. Once other countries and regions introduce carbon taxes, China's exported products can avoid paying carbon taxes at the border, reducing the impact of overseas policies on foreign trade exports.

Secondly, it is recommended to reserve a portion of the carbon tax revenue for the local governments where the tax is levied, so as to mobilize local governments' enthusiasm and promote the carbon transition in the relevant regions. This will also ease the pressure of the future carbon reduction process on the industrial adjustment of the carbon producing regions, helping to avoid the residual effects of the hollowing out of carbon-producing industries.

Third, it is recommended that the carbon tax revenue under the jurisdiction of the central government be used by the central department responsible for dual carbon work, so as to mobilize the enthusiasm of the department. Revenue from the carbon tax can be mainly used to subsidize the research and development of carbon alternative technologies and subsidize carbon negative industries.

Fourth, it is recommended that a schedule of carbon tax rate increases be announced after the introduction of the carbon tax. In the short term, a low carbon tax should be implemented to reduce the impact on the operations of the real economy. However, future increases in the carbon tax rate can regulate market expectations and proactively guide investments in low-carbon or zero-carbon projects.

Fifth, it is recommended to subsidize carbon sink and carbon capture projects according to the carbon tax rate. Carbon sink and carbon capture projects have negative emissions and should therefore be subsidized according to the emissions tax rate. The money for these subsidies should come from the carbon tax revenue.

Sixth, it is recommended to rectify the carbon trading market. Carbon emissions trading and a carbon emissions tax are not contradictory. As a subsidy from the central government, the relevant regions or industries can receive a certain amount of carbon tax-free emission credits in the short term, which can be used to participate in carbon emissions trading. However, the disadvantage of carbon emissions trading is that it is influenced by financial and other factors, making the carbon price unstable. It is suggested that the relevant authorities should appropriately hedge against price fluctuations in the carbon trading market to prevent huge swings in price that could affect prospective carbon reductions.