No. 24 | Is the Economy Back on Track?

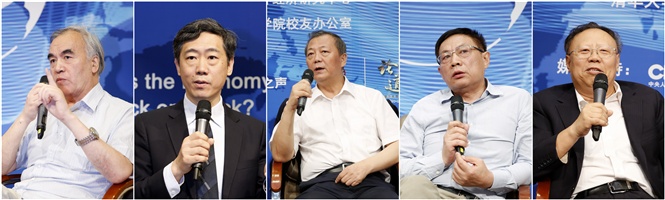

The 24th quarterly forum of the Center for China in the World Economy (CCWE) was held in the International Auditorium of Weilun Building in Tsinghua University on July 5, 2015, focusing on whether China’s economy is back on track. LIU Shijin, former Vice Director of the Development Research Center of the State Council, YAO Jingyuan, distinguished research fellow for the Counsellors’ Office of the State Council and former Chief Economist of the National Bureau of Statistics, CAO Fengqi, Professor with Guanghua School of Management, Peking University, REN Zhiqiang, former Chairman of Huayuan Property Group, and YUAN Gangming, research fellow of CCWE attended the event with Professor David Daokui Li, Director of CCWE leading the discussion. XIE Weihe, Vice President of Tsinghua University, also delivered a speech.

Liu Shijin offered a keynote speech at the beginning of the forum. According to him, China has been experiencing a transformation period in 2013-2015 as economic growth shifted from high to medium-high rate. China’s economy had been growing at a high rate for many years due to large-scale investment and now the three main major components of investment, i.e., infrastructure, real estate, and manufacturing, are all facing substantial difficulties, the Chinese economy still suffers great pressure from the downturn. Liu believes that GDP growth would probably fall between 6%-7% - a new balance for the Chinese economy. To further improve the healthy development of the economy, restructuring production capacity, attaching importance to innovation, and encouraging competition are three important measures.

David Daokui Li then released CCWE’s report on Q2 2015 macroeconomic forecast: Further reform is needed when an economic downturn is in sight. According to the report, the economic downturn is mainly due to domestic problems rather than turmoil in the international market; is due to investment rather than consumption. CCWE statistics show that domestic consumption rose by 10% in the first five months of 2015 while investment fell to 11% and the decrease in the investment in the real estate market alone is enough to account for a decline of GDP by 2%. Therefore, the real estate industry is still key to China’s future economy. When it came to the recent slump on the stock market, Li pointed out that it was completely different from that of Hong Kong in 1998 and the United States in 2008. In the past 3 weeks, a loss of 27% market value accounts for around 5% of public wealth, and therefore, this should not be seen as systemic risk in China’s financial system. Therefore, in the face of recent turmoil, first, no easy conclusion should be drawn at the moment; second, the government should not just step in to bail out the market alone, instead, it needs to uncover relevant institutional problems behind the “crisis” so as to restore market confidence.

After the speeches, guests made more profound and detailed exchanges on the current issues.

According to Yao Jingyuan, there have been structural problems in China’s rapid development in the past few years and we are now forced to slow down a bit. The disappearance of demographic dividends is one of the examples; China’s labor force population is falling by 2 million to 3 million every year - a direct cause for the soaring cost of the labor force in the economy. In China, those above the age of 65 are taking up 10% of the total population and this has made the nation further prone to downward pressure. As a result, it is time for China’s economy to gear down.

Talking about the recent real estate market, Ren Zhiqiang, to the surprise of many, struck a rather pessimistic note. He said that, as a result of a decline of 30% of land approval in the past few months as well as reduced funds and relevant policies, the real estate market is unlikely to bounce back by the end of this year. Ren thought that the sales and prices of China’s real property market, as a backbone in the economy, would gradually return to normal later this year. However, investment in this field would keep moving downward until mid-2016.

Cao Fengqi also offered his point of view in the latest slump of China's stock market and the most talked-about bailout. Firstly, there has not been any solid evidence for or against the short-selling speculation and the sharp fall, according to Cao, was a backfire from the surges in the past few months. CSRC and some large institutions are to be blamed for this overheated stock market and recent freefall which saw A-Shares fall from 5100 to 3600 in 3 weeks. Cao suggested that government should not simply step up to bail out the market, it is better to stabilize it in the first place before using market force to squeeze out bubbles naturally.

At the end of the session, Yuan Gangming shared his view that it was the government's relevant polices, rather than the economy itself, that was dragging the nation back. China chose to tackle the financial crisis by making large-scale investments after 2008, leading to excessive overcapacity in the industry. While the space is still considerable for consumption to grow in rural areas, China was fully focused on investing in large projects, ignoring the fact that domestic need in consumption was not met. The recent growth in domestic retail volume is 10% but the output and added value of all consumer goods industries are falling. He thought that if the government is unable to change its policies, the decline in China’s economy is inevitable.

Before the forum drew to a close, guest speakers elaborated on the impact of the policy regarding the impact that the integration of Beijing, Tianjin, and Hebei Province has on neighboring real-estate markets as well as investment options for the public. The forum ended in a round of applause.