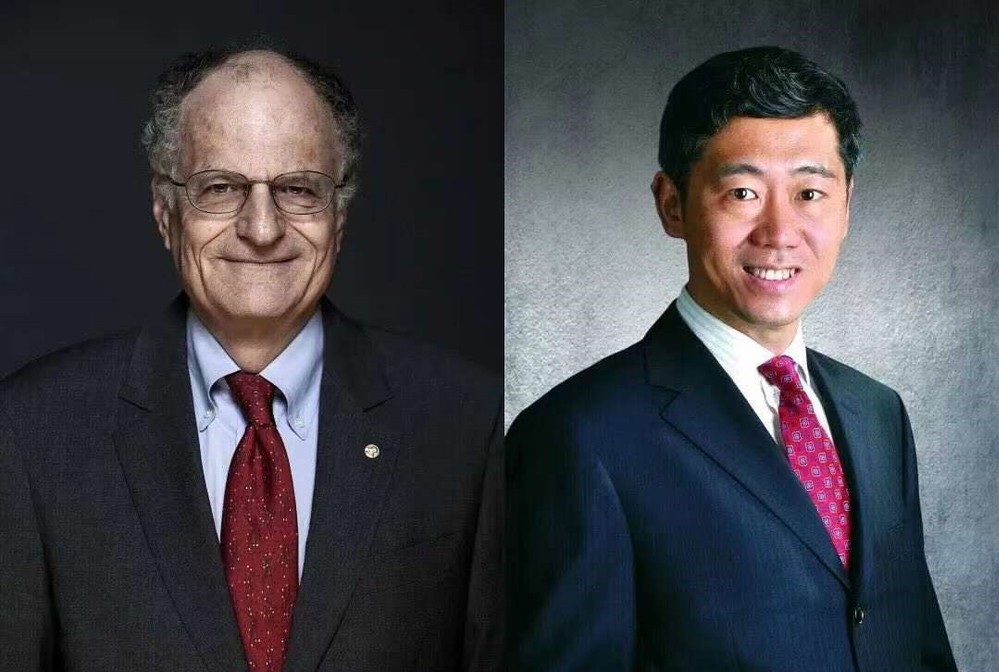

Dialogue Between David Daokui Li and Nobel Laureate Thomas Sargent: China is a Leader in the Digital Economy

Originally published in Chinese by The Beijing News on August 5, 2021. Reporter: Gu Zhijuan. Editor: Li Weijia. Translated by ACCEPT. For the original Chinese article, click here.

The 2021 Seashell Finance Digital Economy Online Summit kicked off on August 5, 2021 with a dialogue between David Daokui Li, Director of the Tsinghua University Academic Center for Chinese Economic Practice and Thinking (ACCEPT), and Thomas Sargent, 2011 Nobel Laureate in Economics. In line with the summit’s theme of “Digital Economy: The Road to the Future, the conversation between the two economists—one from China and one from the US—focused on the development and regulation of the digital economy as well as important issues such as digital currency and shifts in the international economic situation.

Regarding the regulation of major internet platforms, which is currently in the public spotlight, Li believes that an entirely new, overall coordinating body is needed to not only regulate internet companies, but also to try and find ways to facilitate their speedier development.

Sargent remarked that digital currency is one area in which the government should step in, including by issuing its own currency. I've been following the experiments that China has been doing, I've been to a couple of talks, and during my time at the conference, I've noticed a couple of speeches from the leaders of the People's Bank of China. I've been impressed with their technical sophistication in terms of macroeconomics, and the discussions about the currency space have been fascinating. China is one of the first countries to really put digital currency into practice.

Sargent holds that the world currency depends on the monetary and fiscal policies implemented by each country and their impact on business behavior. One hundred years from now, another world currency is likely to emerge, which may be the result of monetary, fiscal, and trade policies implemented by each country.

Both Sargent and Li believe that in 10 years, China and the United States will continue to lead the world economy. Sargent predicts that China and the US will hold a larger share of GDP in ten years than they do now, and perhaps by that time, China will be the largest economy.

Core Points

In China, we must set up an entirely new, overall coordinating body that will not only be responsible for regulating internet companies, but also trying to find ways to promote their speedier development. China's internet companies need a role similar to the commissioner of the NBA, where in addition to being responsible for regulation, we also need a defender to promote the rules of the internet industry.

In 100 years, there will likely be another world currency, which may be the result of the monetary, fiscal, and trade policies implemented by each country.

The international currency battle is not like a boxing match, with two opponents facing each other in the ring. It is more like gymnastics, where each competitor performs their own routine, and in the end, we see who has the least mistakes, more graceful posture, and better balance.

No matter whether they are digital or non-digital, the same economic activities should be taxed in the same way and at the same tax rate. This is because tax rates send the market signals of prices, which can motivate people to use resources most efficiently.

The incentives that the government has created are the key to the miracle of China’s sustained economic growth. The government has created, and continues to create, incentives at all levels to promote economic growth.

China and the United States will hold a larger share of GDP in ten years than they do now, and perhaps by that time, China will be the largest economy.

China is a Leader in the Digital Economy; Chinese Companies are at the Forefront

Sargent: China is a leader in the digital economy.

Li: [The digital economy] is a big industry in China, and the US is also leading the way. Both China and the U.S. are actually at the forefront of the world in the fields of digital economy and artificial intelligence, right?

Sargent: Yes, I think both countries have done a lot of research and have made some definite achievements.

Li: What score would you give us economists in terms of understanding the digital economy?

Sargent: I would give us a B. I think the digital economy starts with businesses, and Chinese businesses are really pioneering, like insurance companies, banks, and online retail—it's remarkable. It's driven by all kinds of artificial intelligence and data processing, and it's a miracle.

Li: I'm slightly more forgiving than you. I would give economists a B+, but in general we are the same, since we wouldn’t give an A. That's very important because that's the basis of the humble attitude we should keep. Do you think we have to stay humble when we talk about the many issues of the digital economy because we are all B or B+ students when it comes to dealing with the new economy?

Sargent: We're also learning. It's brand new territory, so there's not enough experience for us to draw on. We are constantly acquiring, constantly learning—learning by doing, learning by observing.

The Internet Can Break Down Barriers; We Need to Set Up an Overall Coordinating Body to Balance Development and Regulation

Li: Now let's go back to the internet platform economy. I think most of the services actually have little to do with viewpoints and public opinion, and more to do with takeout and how to match your supply of second-hand goods with the needs of others.

Sargent: That's a very good point. Most of the information I get online is so useful. I can get information about things I want to buy—sometimes the ads give me information about different manufacturers and tell me about the attributes of their goods, and you can go online and see what other people are saying about the item. Another thing I do is go online and find information about research projects I'm doing, academic papers from around the world, or computer programs. I write computer code with my friends, students, and colleagues, and I will exchange computer code between my friends in Europe and China. We speak the same language—I don't speak Chinese, but we all use computer languages like Python, Julia, or Fortran. I like to communicate this way because I enjoy dealing with people and I am a free trader in the field of ideas. The internet and artificial intelligence have helped us a lot in this regard, breaking down barriers.

Li: In reality, we have a lot of people who are very concerned about the negative impact of internet platform businesses, so they want to push for their regulation. I've been proposing that in China we should set up an entirely new, overall coordinating body to regulate internet businesses, and furthermore, to try and find ways to facilitate their speedier development.

Sargent: I like the word you said, “overall coordination,” which means integrated, comprehensive coordination. In the United States, we have multiple departments that regulate the same agencies, and sometimes they don’t coordinate with one another. We may have three, four, or five departments—and probably more, because we have so many states—but these multiple regulatory departments don't always coordinate with each other. It creates friction and places a burden on businesses, bringing about some unwise decisions. So, I like the overall coordinated approach that you're proposing.

The other thing that's really important is that this basically has little to do with whether it's the internet or AI, as the boundaries between the various agencies are always changing. For example, there are some companies in the US that are doing online lending, which are doing very well and starting to operate like banks. Instead of looking at the names of these institutions, we should look at the activities that they're carrying out. If they’re facilitating transactions or starting to provide credit, then they are carrying out the business of a financial institution, so there are some boundaries here. There is a natural phase of adjustment when the economy is moving faster than the regulations that are put in place.

Li: Do you like sports? Do you like the NBA?

Sargent: I like all sports.

Li: Let's talk about the NBA. The NBA has a commissioner and a board of directors that not only monitor bad behavior by players and clubs, such as racial discrimination and drug problems, but also take on the role of defending the entire league. The NBA commissioner and the NBA board of directors are responsible for making sure the competition runs smoothly.

So I would make the analogy that Chinese internet companies need a role like the commissioner of the NBA, who in addition to being in charge of regulation, is also a defender to drive the rules of the internet industry.

Sargent: I think that's very sensible. In fact, looking back in history, we have a division called the Federal Trade Commission (FTC), which was created 100 years ago and, according to authoritative history books, was set up to regulate and prevent monopolistic practices in various industries. If you look at how it was set up, you'll see that it was set up more to promote and protect the interests of the industries—more of what you would call “overall coordination.”

Li: You mentioned the Federal Trade Commission, which has been watching Facebook in the United States. Instead of protecting trade, the FTC is charging Facebook, but the charges were dismissed by a federal judge. Is that right?

Sargent: Yes. One thing that has happened again and again in the US, which the great economist George Stigler once talked about, is that companies in an industry compete with each other, and sometimes it happens that one or two companies will come forward to government regulators and try to get them to step in and make it more difficult for certain competitors to compete, and instead of the regulator acting as a neutral judge to promote the industry as a whole, they are more likely to take sides among the various companies.

Li: It is refereed with bias?

Sargent: It's heavily biased. I'll give you an example, this also happens in so-called trade wars—some companies ask for tariffs to make their lives easier, and this hurts other companies in the United States.

China is a Country of Engineers; Engineers Are Generally Not Conceited

Li: The Biden administration has just appointed a legal scholar as FTC chair, who will take charge of drafting regulations for platform companies, and she is very much against internet companies and platform companies. As economists, we don't do a good enough job of understanding these companies, we only get a B or B+, but lawyers might only get a C or a D or even an F. Does it worry you that President Biden is going to appoint her to be in charge of the regulation of internet businesses?

Sargent: I think economists have a lot of insight and they've consistently been doing research, and I think we're all learning. In our foreign policy, economists tend to push free trade too much, so people stop listening to us. For me as an American citizen, I find that very worrisome.

Li: In a way the Biden administration appears too confident, especially to ignore the views of advisors and experts like you.

Sargent: The problem that the Biden administration should be concerned about is that there is an excellent macroeconomist, Larry Summers, who has been sharply critical of the Biden administration's monetary and fiscal policies. The same with Olivier Blanchard. The fact that the current administration has no economists of this caliber and is ignoring the advice they offer is very concerning to me as an American citizen.

Li: It's fair to say that most governments around the world, including the Chinese government, are still trying to get it right when it comes to new issues like internet companies. Not just the US government, but the Chinese government is also trying to find the right answers. So my colleagues and I are working on that, and we're trying to communicate some of our humble views on these issues.

Sargent: In terms of competition, I like what you said earlier. There's a lot of competition between companies aimed at innovation, and that's a driving force. There's a great deal of entrepreneurship, technological excellence, and applied scientific innovation that is inspired between companies, and that's something that society should promote.

Li: In this regard, I think one thing that's reassuring about China is that a much larger percentage of the officials in decision-making positions in the Chinese government are engineers, and I guess more of the officials in key positions in the United States have a law background.

Sargent: I've been to some conferences where I've met two gentlemen who both had an engineering background, one was a governor and one was the owner of a large company, and they were both very good engineers.

Li: You probably know that about 40-42% of Chinese college students major in engineering, and about 3.6 million college students graduate each year with a degree in engineering science disciplines, which is a huge number. Our country is a nation of engineers.

Sargent: I'm envious. I actually studied economics at the undergraduate and graduate levels, but I also took some engineering courses after I graduated with a degree in economics, which was very beneficial. Engineering knowledge is very beneficial in economics, and engineering knowledge is equally useful in regulation.

Li: I think one of the strengths of engineers is that they are not conceited and, on the whole, they are very pragmatic. They know there's a long way to go from theory to reality

Sargent: In fact, my friend Lars Hansen and I have gotten a lot of brilliant ideas from engineering. Cybernetics came out of engineering. As you just said, it’s important not to be overconfident in your theories and plans, and plan for the worst-case scenario so that you can design the building or system to be robust enough to deal with the decisions you make, the assumptions you make, and the scenarios where the assumptions go wrong. This is also the principle you need to follow when overseeing your company or making any rules—this approach will remind you to check that you are doing everything right and that it will not have unintended consequences.

A New World Currency May Emerge in 100 Years Depending on the Monetary and Fiscal Policies that Countries Pursue

Li: You have written a lot of wonderful papers, and I remember one of them was about the French Revolution. You wrote about the economic reasons behind the French Revolution, which you found to be too much debt and a lot of money printing. Are you worried about the impact of the arrival of digital money on the world? Or are you more excited about the coming age of digital money?

Sargent: I'm excited about it. In fact, I've been following the experiments that China has been doing and I've been to a couple of talks, and during my time at the conference, I've noticed a few of the People's Bank of China leaders speaking. I've been impressed with their technical sophistication in terms of macroeconomics, and the conversations about the currency space have been fascinating. It doesn't surprise me that China is one of the first countries to actually put digital currency into practice.

I think digital currency is one area in which the government should step in, including by issuing its own currency. If you go back and read Milton Friedman, who was an advocate of free trade, you’ll see that he also believed there was one area that should be monopolized, and that was the issuance of money—the government should have a monopoly in this area. The reason that he gave for this was to protect the interests of society.

Li: In the US, how long before the Fed conducts its own digital currency experiment? Do you think the Fed will move quickly on this?

Sargent: No, they act slowly.

Li: Are you concerned that the slow pace of the Fed's digital currency rollout will hurt the dollar's status as an international currency?

Sargent: I'm kind of an observer. I've been waiting to see what happens.

If you want to know why the dollar is the world currency today, you should look back in history to find the reason. One hundred years ago, the world currency was the British pound. What events led to the change of the world currency from the pound to the dollar? The fiscal and monetary policies implemented by the UK during the two world wars. During this period, Britain ran huge deficits and was overly indebted, thus changing the country's financial situation, which is actually a lesson for us today. Britain fought two world wars, and the United States participated in those wars, but joined very late and invested very few resources just as the wars were coming to an end. Eventually, fiscal and monetary power were transferred to the United States on a world scale. As a result, these wars had very deadly consequences, and economically speaking, they were all caused by monetary and fiscal policy. If you ask who decided that the dollar would replace the pound as the world currency, no government decided that—it was basically a change made by businessmen out of necessity when drafting the terms of contract settlements. So, I think 100 years from now, there will probably be another world currency, and that could be the result of the monetary, fiscal, and trade policies that countries pursue.

And when it comes to privacy, in the United States, we don't protect the privacy of transactions. This allows for the enforcement of embargoes and that sort of thing. How digital currencies develop and how much anonymity and protection governments provide will be key factors in determining which currency or currencies will be used for international trade, and it will be interesting to watch this process of development.

Li: Let me try to summarize here. First, you argue that the role of the dollar as an international currency is due to good, very prudent monetary policy, fiscal policy that has also been good so far, and a certain amount of anonymity or privacy protection for those who use the dollar. In addition, you make a very important point that within 100 years, another currency will likely become the new world currency. So now I'm concerned about the transition. You predict that a new currency will replace the dollar, so I'm worried about the currency transition, which is likely to happen very quickly, causing the pressure to grow, and as the pressure grows, it will be like a pressure cooker suddenly exploding with a bang.

Sargent: Yes, and that's why Larry Summers' advice to President Biden should be heeded. Larry Summers told Biden that his policies are a significant departure from the previous policies that have brought the dollar to where it is today, and there will be consequences for that. Even though I don't agree with him, I listen carefully because his views have data and reasoning behind them.

Li: I indeed worry that this will be the trigger of the upcoming, most serious global financial crisis to date. When the dollar is no longer a world currency, people will flee from US Treasuries and flee from the dollar. Everyone will be affected by it, including China, and that is my biggest concern. Let's hope that that never happens, or at least let's hope that the transition will be smooth and steady.

Do you agree that the digitization of the yuan, combined with the mismanagement of fiscal and monetary policy in the US will cause the dollar to lose its status as a world currency?

Sargent: That's a good question. When the euro was created over 20 years ago, there were some papers written by very good British regulators and economists among the founders of the euro. At that time, the Maastricht Treaty had rules for monetary and fiscal policies that were designed to limit government deficits, and they had an independent central bank that followed what was in the textbooks, and someone dedicated to drafting those rules. They thought that now that there were rules to follow, within 10 or 20 years the euro would take over the dollar as the world currency. But that didn't happen. I think that if the Europeans had stuck to the rules they said they would at the time, it might have worked, but they broke the rules they made in practice and deviated from the original intent. All of the EU countries, even Germany and France, broke the Maastricht rule and went into massive debt, causing the euro to become much weaker than it otherwise would have been. The EU originally had a chance because the dollar wasn't strong, and at the time the Bush administration had a pretty big deficit and couldn't do anything about it. I think if they had followed the rules, then the world currency could have transitioned to the euro, but that didn't happen.

That is a lesson that can be learned by bankers, really good monetary economists and policymakers, and various institutions in China. From this, you can learn what to do and what not to do if the yuan wants to become a world currency.

Li: Let me make another sports analogy. I think the international currency debate is not like a boxing match—not like two boxers facing off in the ring—but is more like gymnastics, where each competitor performs their own routine, and in the end, we see who has the least mistakes, more graceful posture, and better balance.

Sargent: Sports analogies really apply to economics because many sports look at not just the action in the moment, but the strategy that continues all the way to the end. I also like your analogy about gymnastics because there's an audience involved and they're scoring it.

Online and Offline Transactions Should be Equally Taxed; Government Incentives are Even More Important in the Digital Economy

Li: Let's talk about taxation. Almost every government in the world, including China, is now lacking tax revenue because of the impact of events like the COVID-19 pandemic and the financial crisis that preceded the pandemic. Do you support a flat, low-rate tax on digital transactions? For example, transactions on Amazon, Alibaba, or Jingdong? I support the idea and I think online and offline transactions should be taxed fairly at the same rate, just at a lower rate.

Sargent: I think one of the general principles you're talking about is that the same activity should be taxed at the same rate. If you look closely, whether it's digital or non-digital, the same economic activity should be taxed in the same way and at the same rate. This is because tax rates send the market signals of prices, which can motivate people to use resources most efficiently.

Li: You and I would agree with the idea that a very low tax rate on online transactions would not stifle economic activity on the internet, because people are used to online transactions.

Sargent: I think if I go to a brick-and-mortar store to shop, I need to pay a sales tax, and if the tax rate for online purchases is the same as that of brick-and-mortar stores, then there should be no difference between the two, and it won't affect my shopping habits and drive me to spend offline.

Li: There is a very real problem in China right now, and I believe in the US as well, where new technologies have emerged that are much more convenient than old-style transactions, so people are quickly converting from traditional transactions to new types of transactions, and practitioners who are stuck with the old technologies are left behind. Do you agree that governments or certain sectors should give old traditional industries a grace period to adapt to the new digital economy?

Sargent: These are challenging issues. You mentioned transition many times, and transitioning is always challenging because there are winners and there are losers. We tend to be compassionate to the masses and don't want to leave some people behind, so it's important to achieve a smooth transition in a way that is effective and fair.

Li: Here's a simple case. One traditional cab company has built a cab internet platform, so this traditional cab company has a stake in this new platform, and they can use the profits to compensate the traditional cab drivers, and they can also promote and train cab drivers to bring their business online.

Sargent: That's a good idea, kind of like helping old companies that are using old technology to adopt new technology.

Li: I'm very interested in proper incentives and the role of government in the economy. The government should help the market economy rather than hinder it, which I call government and economics. Do you think that proper government role and incentives are even more important in the internet era than they have been in the traditional economy?

Sargent: Yes, it will be increasingly important. The incentives that the government has created are the key to the miracle of the Chinese economy’s sustained growth. The government has created, and continues to create, incentives at all levels to promote economic growth.

Li: In the United States, about 33-35% of the economy is controlled by various levels of government, including the federal government. Thus, the government has become a major player in the real economy, and whether you like it or not, they are actually the biggest player and shaper of economic life.

Sargent: They have a monopoly on certain matters, some of which they do well, some of which they don't do so well.

China May Be the World’s Largest Economy in 10 Years; Optimism for a Better China-US Relationship

Li: Overall, are you optimistic about the US economy? Do you remain optimistic, at least for the next three to four years of the Biden administration?

Sargent: We have all kinds of problems in our country, and like many countries, we have demographic problems—the population is aging. I'm not an optimist, I don't like the monetary and fiscal policies of this administration or the last administration, and I think we should be more cautious when it comes to getting close to balancing the budget, and being wary of inflation. But if you look at the history of the United States, you will see that the US economy has grown about 2% per capita per year, independent of whether there was a Democrat or a Republican in power, independent of the marginal tax rate. That's really surprising, as there have been a lot of economic policy changes, but the economy is still moving slowly forward, and that's what makes me optimistic. This is very different from what China has experienced over the last 40 years, and eventually China will experience a similar scenario because the economy can't keep growing at 6-8% forever—that growth rate is very rapid.

Many of the policies that President Biden is implementing are actually very close to Trump's in a number of ways, such as spending a lot of money on government without worrying about financing. Trump did that, and Biden has done that and more.

Li: Let's look at the outlook for the next 10 years. You and I are both economists, so we tend to look at fundamentals and not short-term fluctuations. Let me talk about the fundamentals: first, the US is still the largest and strongest economy in the world and still has tremendous innovation capacity; second, the Chinese economy is still weak relative to the US, although China is moving toward the threshold of a high-income economy. Furthermore, both countries are leading in internet and artificial intelligence technologies.

Putting these fundamentals together, what are your expectations and assessment of the relationship between the two countries in 10 years’ time? Will China and the US be working together again in 10 years for the benefit of their people and the global economy? Will the two countries still be leading the world economy?

Sargent: I think they will. I think China will become a bigger economy than the United States. The key is that China is producing so many engineers and scientists. If you look at the number of Ph.D. scientists and how the quality of Chinese universities is improving in all fields, especially in science—which are leading indicators of substantial growth—I think that the ratio of GDP between China and the United States will be greater in ten years than it is now, and perhaps China will be the largest economy.

Some of China's cities are already advanced cosmopolitan cities, and in terms of infrastructure or GDP per capita, cities like Guangzhou, Shenzhen, or Shanghai are strikingly world-class. If you're my age, it's a miracle to witness these changes.

Li: Beyond that, I'm optimistic that the two countries will have a better relationship in 10 years. I believe we can resolve our differences in 10 years because there are a lot of smart people like you and good students like me in the United States.

Sargent: I hope so. I'm also a student of yours, and I have benefitted more from you today.

Cautious Optimism About US Outbreak Control; The Problem Is That Too Many People Aren’t Willing to Get Vaccinated

Li: In general, are you optimistic about the control of the pandemic in China and the United States?

Sargent: I'm cautiously optimistic. The problem is that in the US, there are too many people who are reluctant to get vaccinated, which is quite tricky for us. But there are also a lot of people who have been vaccinated and it seems to be working quite well.

Li: China is also recovering gradually. Things are moving in a good direction, and about 60% of the population has been vaccinated. At this moment, however, we are facing another problem, which is the annual flooding, which has occurred in many cities this year. This shows that climate change is a big issue for China.

Sargent: Yes, it's a major issue.